Chief executives should remember there’s success in succession

One super power I wish I possessed is the ability to see around corners. While I thrive on tackling the unexpected, I like to be prepared for it. So I feel for John Henry, whose Fenway Sports Group owns Liverpool Football Club.

In November, Jürgen Klopp — one of the club’s most successful managers — secretly told him that he wanted to quit after nine years in the job and only months after renewing his contract. How do you replace one of the world’s most dynamic leaders, keep customers happy and ensure top talent stays during a smooth transition you haven’t properly planned for?

• Jürgen Klopp’s human side forced him to walk away from Liverpool

An orderly succession plan requires years of planning, not months, preferably with great internal candidates. It is the kind of planning being seen at JP Morgan, where the bank’s chief executive, Jamie Dimon, has identified five leading candidates to take over when he steps aside.

A Harvard Business Review analysis a few years ago estimated that the power vacuums, drift and poor decision-making caused by bad chief executive successions wiped out $1 trillion in market value from the S&P 500 in a year, while investor returns could be 25 per cent higher with good plans.

There are plenty of examples of great succession work: within a couple of years of returning to Apple as chief executive in 1997, Steve Jobs hired Tim Cook to work alongside him in various roles, handing over the reins to his protégé shortly before he died in 2011. Cook, in turn, has laid out a well-planned succession.

Britain’s companies should watch and learn. A Chartered Governance Institute report found that only 54 per cent of FTSE 350 companies had a written succession plan for the board.

My advice to chief executives is to start planning your succession three years ahead. You need to give your chosen candidates a challenging series of roles to see what they’re made of. Not only do you want them to develop skills and deepen their knowledge about the business, but you also want to assess their character. Often, it’s only by seeing how they behave out in the field that you can tell if they’re an ego-free team-player or a political power-player. And take it from me: you want to hire the former, not the latter.

Years of research conducted by the business guru Jim Collins showed that the best-performing companies were the ones that had well-established systems for training, retaining and promoting insiders. As he said: it’s not the quality of leadership that matters so much as the “continuity of quality leadership that preserves the core values and purpose of the institution while simultaneously stimulating progress into the future”.

However, if you don’t have the internal talent, you may have to look outside for your successor. Remember, this is high risk, so don’t scrimp on your due diligence. Really test whether they have proved themselves in their past and current roles, and make sure you’re confident that they are the right cultural fit for your business. Also, I would advise against poaching a chief marketing officer or chief operating officer from a rival with a promise of the top job. Not only are they unproven as chief executives but they’re also outsiders — you’re just doubling your risk!

At chief executive level, you need someone who has proved themselves as an exceptional leader, if not in your market then in a parallel one. Tufan Erginbilgic, who previously ran a big chunk of BP’s operations, has had an extraordinary impact at Rolls-Royce, bringing a focus that the company desperately needed. Bringing a fresh pair of eyes, with experience in global deal-making and a determination from his BP days to ditch unprofitable contracts, Erginbilgic has transformed the company.

Getting the timing right on your succession plan means being honest with yourself about how long you want to be the boss. Don’t just stay in the job because you can, have the humility to know — like Klopp — when you can’t give it your all. I’ve been so committed and passionate about my businesses that, at times, I’ve found it hard to confront succession planning. The buzz you get from being both founder and chief executive is incredibly addictive and there were moments when I should have been looking to the long-term, beginning the transition sooner than I did.

I ran things for 30 years but, if I’d known the secrets of growth that I do now, I probably could have achieved the same success in half the time. If you’re in a public company, you have a fiduciary responsibility to reveal information about a chief executive who is planning to step aside, but beware: if you announce a departure too early, the danger is that they’ll come across as a lame-duck leader.

Finally, succession planning should never be done behind closed doors. If it’s open and promoted as business-critical, your teams will see the opportunities that come with it. It’s motivating for staff and executive teams to know that their organisation wants to encourage staff to look for the next step up. And, if you do manage to hire for the role internally, you’ll need to start thinking about who will take their place and when. As the boards of NatWest and BP will no doubt attest, you never know what’s around the corner.

So be prepared for the unexpected and, remember, there’s success in succession.

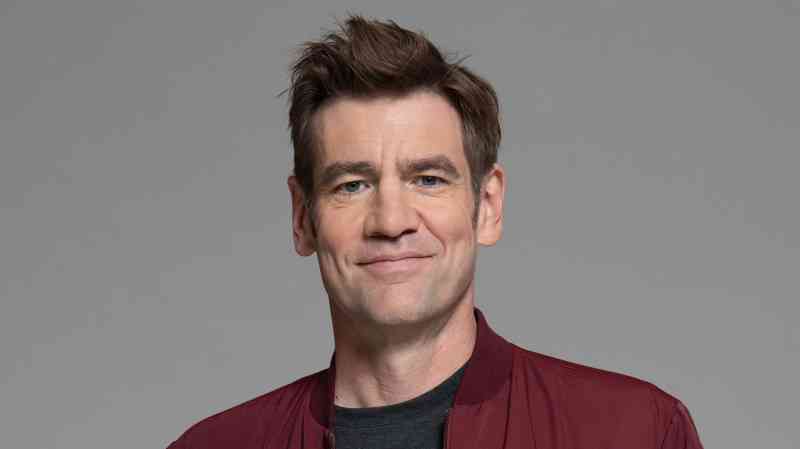

Richard Harpin is founder and chairman of HomeServe and growth partner and owner of Business Leader magazine